Channel News

Survey Reveals Low Satisfaction Rates With Current Visibility Into Channel Incentive Programs

Although incentive program performance is considered vital to channel program success, the majority of companies are not up to par in their measurement, according to findings from a survey of senior channel sales and marketing executives.

The survey, conducted by Channelinsight, revealed merely 33% of survey respondents stating they are somewhat or very satisfied with the current status of their company’s incentive program. Channelinsight is a cloud-based, channel sales management solution designed to provide technology providers with visibility into partner and end-consumer transactions.

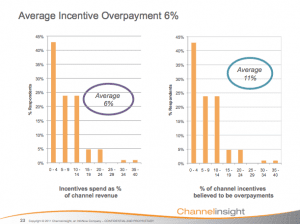

Cost inaccuracy was another qualm respondents had in current strategies. On average, respondents believe they overpay on incentive program development by 6%. Furthermore, only 40% indicate that company channel incentives are calculated and processed automatically.

“In any industry, information and insight is key to success, but when it comes to channel sales, information is at a premium,” said Mark Greene, CEO, Channelinsight. “Without quick, accurate sales data, companies experience lost revenues, overpayments and ineffective incentive programs. Today’s survey results validate the need for greater visibility into channel sales and demonstrate that companies need new tools to help them attain this information.”

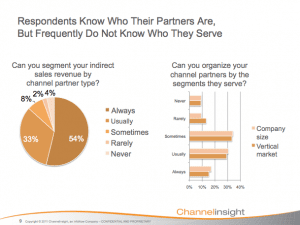

Survey results also concluded that although majority of companies can identify partners — with 87% saying they can always or usually segment their channel revenue by partner type — more than half (54%) of surveyed marketing professionals said they have no insight into market segments.

Due to these inaccuracies, countless BtoB organizations within the channel are challenged to accumulate more accurate and detailed end-customer data. Although 68% of respondents can usually or always identify the end-customer in indirect sales, only half of those respondents consistently receive actionable end-customer data and segmentation information. Furthermore, despite 66% of respondents explaining it is vital to consult partner and end-customer data throughout the planning and decision-making process, only 39% expressed satisfaction with customer and partner data provided by their company.

More than have (57%) of respondents rely on internal team research as a primary source for end-customer segmentation information, while only 28% used a third-party service.

More than have (57%) of respondents rely on internal team research as a primary source for end-customer segmentation information, while only 28% used a third-party service.

Channelinsight compiled survey results from 112 sales, marketing and channel operations professionals in large to mid-sized companies within the high-tech and software industries in the Baptie Channel Focus Community, a sales and marketing executive conference organizer and Channelinsight partner. Half of the respondents involved in the survey belong to companies that drive more than 60% of revenue through the channel.

In the last year, Channelinsight reported substantial growth, with a 183% increase in new bookings versus Q1 2010. As a result, the solution provider has added new members to its management team, including Roger Metz as Chief Financial Officer and Tom Aliotti as VP of Worldwide Sales. David Bacon was announced as VP of Technology and Kurt Kaynor has been named new VP of Professional Services.