Channel News

Expanding Channels Ecosystem Landscape Generates $3.9 Billion In Sales

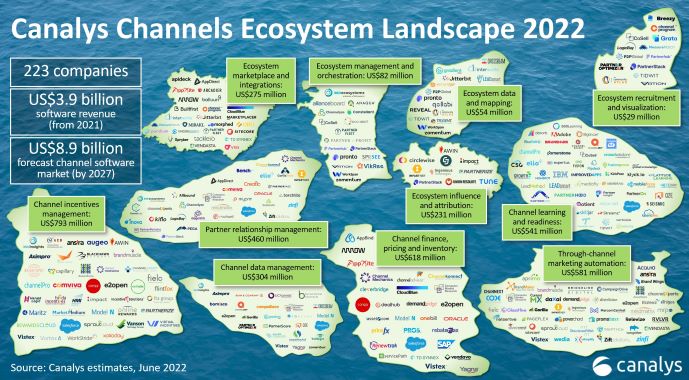

The number of companies offering solutions that enable brands to more effectively manage their channel ecosystems continues to grow. In its first Channels Ecosystem Landscape report, Canalys, an independent analyst company, lists 223 different companies with combined annual sales of $3.9 billion.

The market for channel ecosystem enabling products is expected to continue to rise, wrote Jay McBain, Canalys’s Chief Analyst – Channels, Partnerships & Ecosystems. Canalys expects the channel software market will reach $8.9 billion in revenue by 2027. The research currently excludes China, India, and parts of SE Asia as Canalys continues to examine the markets and to apply its global research methodology, the company said.

In his last annual review of the Channel Software Tech Stack as Forresters’ Principal Analyst, Channel Partnerships & Alliances, McBain counted 183 companies offering channel program supporting solutions. At the end of 2019, McBain’s survey listed 159 companies. As 2018 came to a close, 106 solution providers were identified.

Ecosystem management solutions providers accounted for much of the landscape’s expansion. For the Canalys report, McBain created five distinct ecosystem management categories including:

- Ecosystem Data & Mapping;

- Ecosystem Management and Orchestration;

- Ecosystem Marketplace and Integrations;

- Ecosystem Influence and Attribution; and

- Ecosystem Recruitment and Visualization.

Combined these categories now include 80 different companies — up from 33 in 2021 — generating $672 million in revenue. Demand for the solutions they offer is rising dramatically, said McBain. “To show how quickly these categories are growing, in a matter of three years the companies in them have now over-achieved what took either the PRM (partner relationship management) or TCMA (through-channel marketing automation) categories 30 years to do in revenue.”

The demand for channel ecosystems solutions is broad, said McBain. The largest consumers of the solutions are technology companies, which currently account for about 25% of the overall spend. But business in 27 different industries are also adding ecosystem solutions to their technology stacks. “As every company in every industry becomes a ‘tech’ company,” said McBain, “their spending in these categories is going up significantly.”

The Canalys data reflects other surveys that see an expansion of channel ecosystem programs. For example, the second annual Channel/Partner Marketing Benchmark Survey conducted by Channel Marketer Report and its sibling publication Demand Gen Report, found that fully 96% of respondents expect to increase revenue directly attributed to their partner ecosystems this year.

Of the respondents, 82% will be adding to their roster of partners. Partner program budgets will be boosted by nearly 70% of those surveyed, as they upgrade a variety of support services and activities such as partner training, channel incentives and partner relationship management.

There are increasing demands on channel professionals to find, recruit, onboard, develop, incentivize, co-sell, co-market, co-innovate, measure, manage and report on partner value at scale, Canalys noted. Automation, deeper integrations and data-driven decision-making are creating measurable competitive advantage through partnerships and are quickly becoming table stakes in the industry.

$3 Billion In Private Equity Funds Growth

Investors are taking note of the opportunities the market for channel ecosystems solutions represents. The companies listed in the Canalys report raised over $3 billion in private equity funding last year, said McBain. In 2021, CMR reported that Crossbeam, a provider of a collaborative data platform that enables vendors and their partners to determine overlapping accounts, announced a $76 million Series C investment. The company has since acquired Partnered, an account-based networking tool maker.

Impartner, a pure-play SaaS-based channel management and partner relationship management (PRM) provider, raised $50 million in funding. At the time, the investment raised Impartner’s total funding to date to more than $113 million.

Mirakl, the provider of an enterprise marketplace SaaS platform, raised $555 million in a Series E funding. Impact, a global partnership management platform provider, announced $150 million in funding. And Tackle.io, a software company dedicated to helping software providers generate revenue through the Cloud Marketplaces, raised $35 million in Series B funding. PartnerStack, a partner relationship management solutions provider, raised $29 million USD in Series B funding.

In July, Allbound, a leading partner relationship management (PRM) platform, announced a $43 million majority investment from Invictus Growth Partners, a private equity firm. The capital will be used to accelerate investments in sales, marketing, and for further enhancements to the company’s PRM platform.

It’s likely that Canalys’ channels ecosystem landscape will include more companies next year. To be included on the list, McBain said that he ensures that each company’s product is generally available, customers are using them and satisfied with their performance. “I make sure they’re real,” he said. Hoping they will be listed in the future, he said, is a “list of a dozen startups that haven’t met the criteria yet, that are still in pilot mode, beta mode, alpha mode.” So more to come.